Crop Insurance for Small Grains: Individual, Custom and Whole-Farm Plans

While diversifying a crop rotation with a small grain can provide a myriad of benefits, it can also feel like a risky endeavor. Insurance is one way farmers can mitigate some of that risk. Crop insurance policies are widely available for corn and soybeans across the Midwest, but what about for oats, rye and the rest of the small grains?

Back in 2017 we wrote about the options for small grains crop insurance and we revisited that topic in our September shared learning call with Carly Krump and Craig Christianson from the Risk Management Agency office in St. Paul, Minnesota.

It’s worth stating off the bat that crop insurance can get complicated fairly quickly. While regulated by the government, crop insurance is purchased through private companies. The Risk Management Agency (RMA), which oversees crop insurance programs, has regional offices around the country. For Iowa, Minnesota and Wisconsin the RMA regional office is located in St. Paul, Minnesota. We’ll be pointing out some helpful information here, but it’s always a good idea to talk through the nitty gritty with your local insurance agent or with your regional RMA office.

Ready-Made Options: The Individual Plan

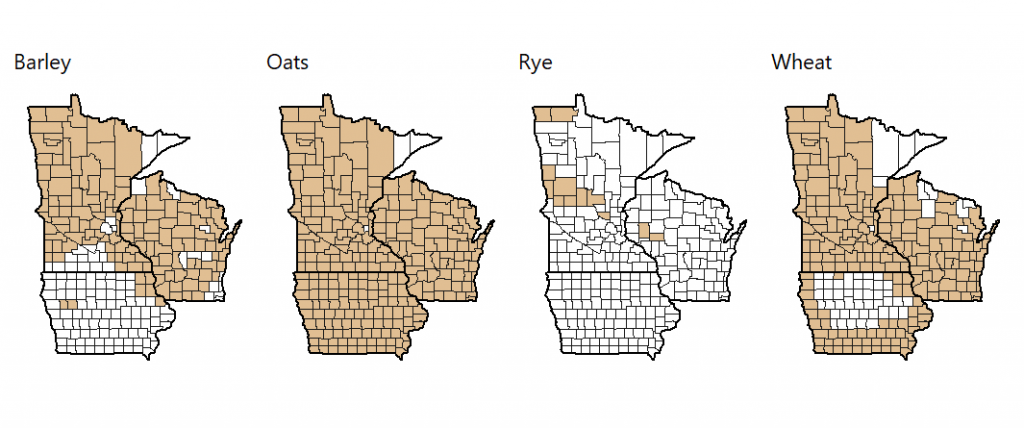

Individual crop insurance plans, as the names suggests, only cover an individual crop. If you’re interested in insuring a small grain you should first and foremost look up whether there are already individual insurance policies available in your state or county. There are a couple ways to do this: you can search on a map here or you can search from a list here. Keep in mind that some small grains, like oats, are insured across the state of Iowa, while other small grains, like barley and wheat, are only insured in certain Iowa counties. See the maps below for the counties in Iowa, Minnesota and Wisconsin covered by commodity programs for different small grains in 2020.

Maps of counties where individual crop insurance plans are available for small grains in 2020. Note that insurance options (ex. revenue protection, yield protection) vary by small grain crop.

The following handouts are helpful in providing an overview of the existing individual crop insurance policies for small grains in the upper Midwest region:

- Barley (Iowa, Minnesota, Wisconsin)

- Buckwheat (Minnesota only)

- Flax (Minnesota only)

- Oats (Iowa, Minnesota and Wisconsin)

- Rye (Minnesota and Wisconsin)

- Wheat (Iowa, Wisconsin)

Within Iowa, Minnesota, and Wisconsin, not all small grain crops have the same insurance options. For example, oats in Iowa are only covered through Actual Production History (APH)-based policies. In contrast, wheat in Iowa can be insured through yield protection, revenue protection or revenue protection with harvest price exclusion.

Our previous post about crop insurance for small grains walks through some of these different insurance types. Additionally, each of these handouts has a “Loss Example” section which is especially handy for understanding how your indemnity (aka, your compensation) is calculated based on your insurance type. The sales closing dates for individual crop insurance plans are September 30 for winter-seeded small grains and March 15 for spring-seeded small grains.

No Individual Plan? No problem! Custom Insurance Options

What if a small grain isn’t covered by any of these individual policies in your county? A farmer growing cereal rye for grain in Iowa, for instance, doesn’t have any “off-the-shelf” individual plans to insure their crop. If this is the case, a farmer can submit a “Request for Actuarial Change” otherwise known as an XC agreement. An XC agreement acts like a custom individual crop insurance plan.

An XC agreement requires a 3-year yield and production history for the crop. If you’re looking to insure a crop you’re new to growing, then you can submit verifiable production history for a similar crop. Using our rye example again, if a farmer is new to growing rye, they could submit yield and production information for buckwheat, canola, or another small grain. If a farmer doesn’t have a production history of a similar crop then RMA still needs a farmer’s verifiable production records (load summaries, elevator receipts, storage facility records, etc.), and the farmer will have to submit yield data from the county. If you need help finding yield data for a crop in your county contact your local extension office or Practical Farmers of Iowa.

Additionally, an XC agreement requires information about estimated planting and harvest dates as well as the name and location of where a farmer is planning on selling or using the crop. The due dates to submit an XC agreement are the same as the due dates for individual crop plans: September 30th for fall-seeded and March 15th for spring-seeded small grains. If you need further assistance navigating an XC agreement with your private insurance agent, or if you’re confused about whether your production records are “verifiable,” then you can contact your regional RMA office. Carly Krump (carly.krump@usda.gov) at the St. Paul regional office can help farmers in Iowa, Minnesota, and Wisconsin.

When Can I Expect to see a Small Grain Individual Plan in my County?

The reason that individual crop insurance plans don’t exist everywhere is that RMA creates crop-specific insurance policies based on demand. If there are few to no farmers growing rye in an area, for example, then there’s little incentive to create a policy to insure rye in that region. However, RMA does crop program expansions every year and so showing interest is important. The best way for a farmer to demonstrate their interest in an individual crop insurance plan is for them to file an XC agreement. This shows that there are people already using crop insurance even when the “off-the-shelf” plan is unavailable. If you’re unable to file an XC agreement, then send a letter or an email to your local RMA office indicating your interest in expanding crop insurance policies to your county. Carly Krump (carly.krump@usda.gov) at the St. Paul regional office is the contact person for farmers in Iowa, Minnesota, and Wisconsin.

Insuring it all – Whole Farm Revenue Protection (WFRP)

The last option to insure small grains is to insure the whole farming operation. Whole Farm Revenue Protection does just that – it covers revenue for all commodities on a farm. This includes crops, livestock, and products for resale. It does not include timber or hobby animals. Since everything on the farm is insured together individual commodity losses are only considered on the level of whole farm revenue.

A farmer who only raises one commodity can adopt a WFRP policy (assuming that commodity isn’t already covered by an individual crop plan), but the benefits accrue with greater diversification. For example, in order to obtain a coverage of 80-85% from WFRP a farmer needs to have at least three commodities. Furthermore, the larger the number of commodities a farmer has the higher the discount they can apply towards their premium. Importantly, the number of commodities grown on a farm isn’t just a simple count. Instead each commodity must reach a minimum revenue level to be included. WFRP does not cover commodities that stay on the farm.

A farmer can have an individual plan for some of their other crops and still have WFRP, however the amount of liability included in individual crop policies will be deducted from WFRP premium prices. For instance, say a farmer could have $500,000 in WFRP insurance coverage, but half of that coverage comes from individual crop insurance policies for corn and soybeans. The WFRP premium would then actually be based on $250,000. Any indemnity a farmer receives from an individual plan will count towards their whole farm revenue. In other words, a farmer can stack individual and whole farm crop insurance policies but most often they won’t get paid twice, unless there is a lot of damage.

To learn more about WRFP and decide if it’s the right plan for you, check out this fact sheet. Our previous crop insurance post also walks through some of the tax documentation required for WFRP. Craig Christianson (craig.christianson2@rma.usda.gov), who works for the regional RMA office in St. Paul Minnesota, can assist farmers with Whole Farm Revenue Protection in Iowa, Minnesota, or Wisconsin.

Interested in learning more about small grains? Join future shared learning calls and get resources on small grain production delivered straight to your inbox by signing up for our monthly small grains newsletter.