Frequently Asked Questions About Small Grains Markets – 2022 Update

When considering whether or not to grow small grains one of the main things farmers consider is: can I sell them? In order to answer this big question, farmers often have to answer several smaller questions first, namely where to sell, how to sell and what quality specifications they are expected to meet.

To help farmers answer these questions, in 2017 we convened Jessie VanderPoel from Grain Millers, Tim Marlin from the DeLong Company and Scott Woodside from Cargill, and in 2021 we hosted Mike Schulist from NF Organics on our shared learning calls, all to talk through the process of how small grains are priced and sold. From these conversations, we’ve compiled answers to the most frequently asked questions about small grains markets.

Where do I Find a Market?

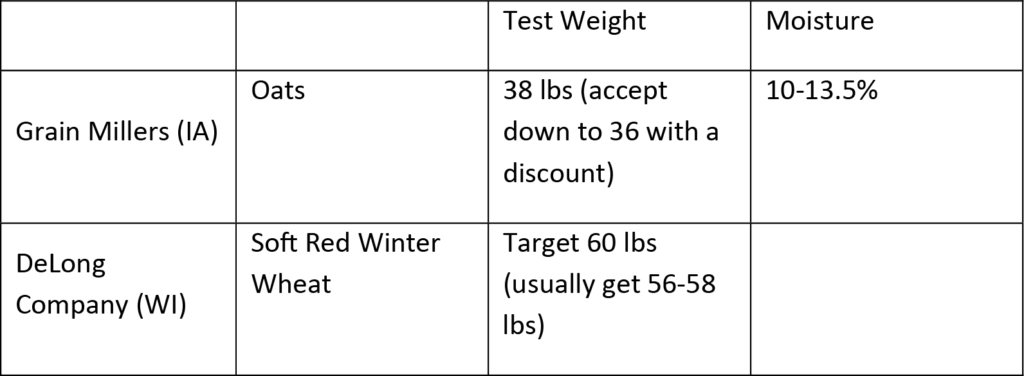

The single most common question about markets is simple – where are they? Farmers who are considering adding a small grain to their operation have likely already run into the issue of a lack of market options. There are certainly some large small-grain buyers across the Midwest. For instance, Grain Millers has a mill in St. Ansgar, Iowa where they purchase both organic and conventional small grains, primarily oats, and DeLong Company buys mainly soft red winter wheat in their elevators throughout Wisconsin and Northern Illinois.

Outside of larger companies, market options can be sparse but it’s worth checking with your local elevators and coops, who often buy some small grains for livestock feed. Practical Farmers and Albert Lea Seed House both have small grain business directories that provide leads for other food and feed buyers.

How Far Should I Haul My Grain?

The choice about how far to haul grain is fundamentally an economic question, so there’s no hard and fast rule. Ideally, you would market your grain within 20-30 miles of the farm, but given the scarcity of market options available, local options don’t always exist. Most growers enrolled in PFI’s small grains cost share don’t haul grain more than 120 miles, although there are certainly exceptions depending on price and volume delivered.

Do I Need to Forward Contract or Can I Get a Spot Contract After Harvest?

The type of contract required depends on the buyer. Grain Millers, for instance, processes grains as they come in, so you have to arrange a time for delivery at the mill in advance. You can get a contract for a delivery date as early as fall of the previous year. And depending on the crop, they might fill up delivery slots during certain months, so it’s essential to think ahead about contracting, especially if you don’t have storage.

Should I Hedge My Grain?

For widely grown and traded crops, like corn and soybeans, grain is often hedged. Hedging reduces financial risk, given the uncertainty of future prices, by having some grain contracted before harvest and some grain contracted after harvest. For small grains in a typical year, prices will be highest when bids are released in the winter, favoring those who forward contract early. However, 2021 was an atypical year, at least for oats, with prices increasing throughout the spring and after harvest, favoring those who did not forward contract.

If you’re growing enough acres of small grains it might be worth thinking of hedging. For the DeLong company, Tim suggests selling 25% of the wheat crop through contracts when it’s planted in the fall, 25% if the crop comes out of winter well, and then selling the remaining 50% at the elevator after harvest. While Grain Millers usually requires a forward contract, farmers can still forward contract 50% of their acres in January and the remaining at harvest.

What Types of Grain Specifications do I Need to Meet?

If you’re growing for a food or feed market, chances are your grain is going to need to meet certain specifications.

For oats, milling markets will have the most stringent requirements for test weight, however feed markets may also want heavy grain, with a test weight of at least 34 or 36 pounds per bushel. If you are hauling your grain a significant distance to your market, it’s good practice to send a sample to the buyer ahead of time. Some companies, like Grain Millers, already require a sample before delivery. This can give you a better idea of whether you’re looking at any discounts and need to divert your crop to an alternative market.

With wheat, high vomitoxin levels – created when a small grain grows a fungus such as fusarium head blight in May or June – can make buyers reject the grain for milling and push it to the feed market at $1-$1.50 less per bushel. Delong Company recommends applying a fungicide to the crop as a protection measure to improve quantity and quality. Read more about disease management in wheat here.

How do I Predict Prices?

Small grains are a “carry” market, meaning that the longer you can store your grain after harvest the better price you will get. For instance, oat bids will typically increase by $0.50 per bushel if you can hold your grain through corn and soybean harvest. While oat prices are listed on the Chicago Mercantile Exchange, most buyers do not adjust bids based on live trading. Instead, bids are adjusted more infrequently and are driven by Canadian production.

Wheat prices are more strongly traded and therefore prices are predicted through traditional channels like the Chicago Board of Trade. The DeLong Company uses the July futures for their bids, which can be found on their website. Similarly, larger companies do business with enough farmers that their current prices and bids are constantly updated online (ex. Cargill and ADM).

What’s Going on With Oat Prices in 2022?

Historically, oat prices have hovered between $2 and $4 per bushel. However, 2022 bids are roughly double that, ranging from $6 to $7 per bushel depending on delivery time. The reason? A drought in the northern US and Canada during the 2021 growing season has drastically decreased global supply. While it’s hard to say what will happen in the future, sustained disruptions in global supply chains could mean oat prices stay above historical averages for the next couple years.

Interested in learning more about small grains? Join future shared learning calls and get resources on small grain production delivered straight to your inbox by signing up for our monthly small grains newsletter to get details sent directly to your inbox.